March Madness®: Bonds Move from the Bench to the Big Game

In the coming weeks, March Madness basketball frenzy may be a welcome distraction from non-stop news around the spread of the coronavirus. This month’s hyper-focus on basketball also provides a helpful analogy for what’s happening with many investors’ portfolios during this period of market volatility.

Many CornerCap client portfolios are balanced by a mix of appreciation and preservation assets. In basketball terms, appreciation assets are the stocks that play offense – driving toward the client’s long-term growth goal.

But each portfolio also needs defensive players, which are preservation assets such as bonds. In times of heightened market volatility like we’re experiencing now, preservation assets shine while we’re reminded of the inherent volatility of appreciation assets.

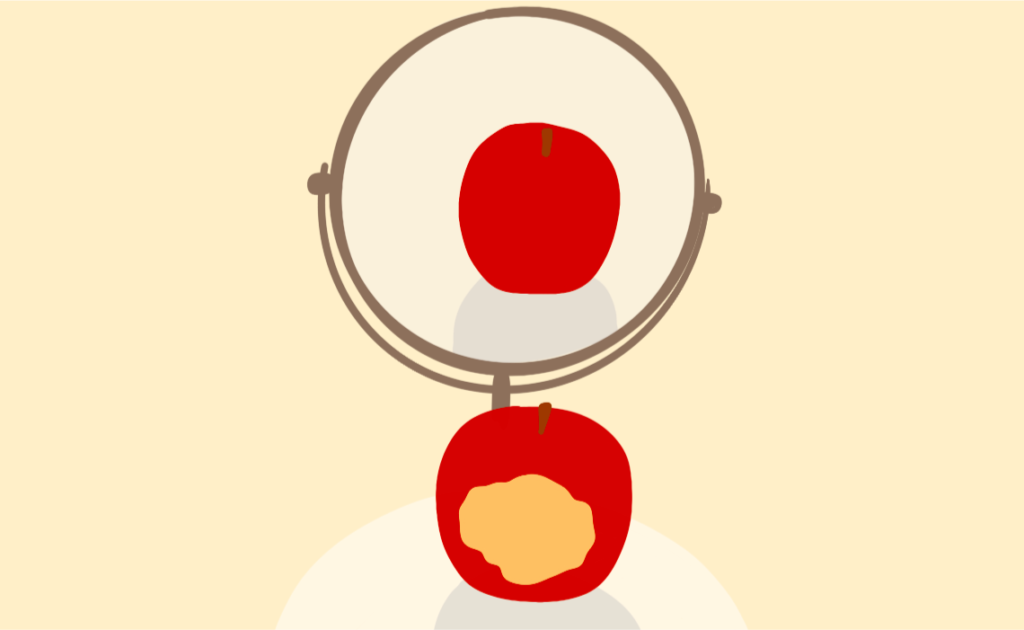

In the recent decade-long bull market, short-term investment-grade bonds may seem to have an odd place in a portfolio when their returns lag those of stocks. True to their defensive nature, these bonds have barely kept up with inflation over the last few years – leading some investors to question why they’ve even been part of the portfolio.

In basketball terms, bonds are our bench players. If everything goes right during the whole game, you never need to call on them. In a perfect offensive game, your starting five players could run points on the board for the duration of the game.

But in basketball, just as in the reality of the stock market, obstacles to the elusive perfect game inevitably arise. Starting players get tired, injured or they foul out. In these moments, bench players become critical to success of the overall season.

The first two weeks of March have been a vivid reminder of just how many obstacles can emerge in the long game that is stock investing.

Since 1980, U.S. Large Cap stocks have averaged an intra-year decline of 13.2% while maintaining average full year returns of 13.1%.* These stats remind us that the current market pull back is consistent with stock market history going back to 1980.

The question on every investor’s mind is of course “will it be worse this time?”

No one can definitively predict the answer. But just as basketball coaches make real-time adjustments in reaction to changing dynamics of every game, CornerCap Wealth Advisors make appropriate adjustments to our clients’ unique portfolios.

Those bonds that have been sitting on the bench in recent years have retained their value during the recent stock market decline. As a result, a portfolio with a targeted allocation of 70% stocks and 30% bonds has now shifted to 65% stocks and 35% bonds. That means it’s time to change up the players, selling some bonds to buy stocks and return the portfolio to its targeted 70% stocks / 30% bonds allocation.

Based on historical trends, it’s anticipated that these newly purchased stocks will rise in price over the next few years while those bonds that have been sitting on the bench all this time finally get some credit for contributing to portfolio returns. Over time, as the portfolio allocation reaches 75% stocks and 25% bonds, your advisor will sell some stocks and buy some bonds to put the bonds back on the bench.

CornerCap Wealth Advisors take a customized approach to every client’s portfolio based on their unique circumstances. Just like your favorite team’s coach during the coming weeks of March Madness, your advisor will be making necessary adjustments to your portfolio to set up the right mix of offensive and defensive players in your portfolio for not just today’s game, but the seasons of market recovery to come over the next several years.

*Source: CornerCap, Bloomberg